Bitcoin as a Strategic Asset for Family Offices

Authored by Glenn Cameron, CFA, FMVA and edited by Marc J. Sharpe, M.A., M.Phil., MBA

Abstract

Family offices seek to preserve purchasing power, prudently grow capital, and reflect family values across generations. Traditional portfolios—heavy in equities, bonds, private markets, and real estate—face structural pressure from persistent inflation, high public debt and net‑interest burdens, rising cross‑asset correlations, and liquidity traps in illiquid alternatives. This whitepaper explores how a measured Bitcoin allocation can complement a family’s core portfolio by adding a programmable scarcity hedge, a low‑correlation return stream, and long‑term growth optionality. It also provides practical guidance on sizing, phasing, custody, governance, and liquidity planning to integrate Bitcoin in line with a conservative family‑office mandate.

Executive Summary

· The evolving macro environment has weakened traditional diversification: cash and bonds struggle against inflation and provide less diversification, while equities, credit, and real estate have become more correlated in times of stress.

· Bitcoin’s core attributes—finite supply, decentralization, and independence from fiat monetary policy—map to three family‑office objectives: preserve purchasing power, diversify real risks, and retain growth optionality.

· A modest 1–5% sleeve can improve portfolio resilience without dominating governance or liquidity. Historically, Bitcoin’s correlations to equities and bonds have been low, while long‑run CAGRs have been high (with significant volatility).

· Implementation should emphasize phased entry (i.e. dollar cost averaging), policy‑based rebalancing, institutional‑grade custody—preferably multi‑institution, multi‑signature—and a total‑return approach to generate cash when needed.

· Values alignment is also possible given credible narratives around financial inclusion, human‑rights resilience, and supporting the energy transition.

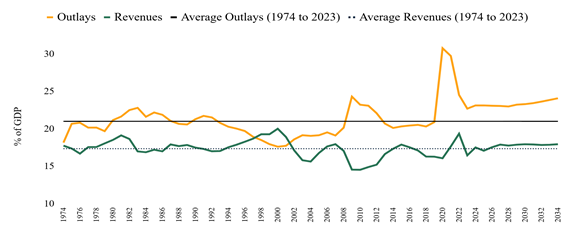

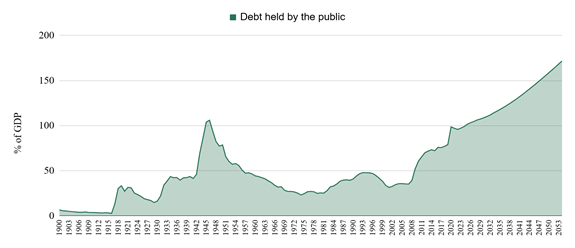

1) The family‑office mandate - and why the old toolkit is strained today

The family office mandate spans more than annual returns: protect real wealth, fund multi‑decade commitments, and transmit values and governance to the next generation. That mandate is harder in an era of persistent fiscal deficits, rising debt‑to‑GDP, and growing federal debt net‑interest costs that can pressure fiat purchasing power over time.

At the portfolio level, five structural weaknesses are increasingly visible:

1) inflation erosion benefits in cash and bonds.

2) liquidity traps in private equity and real estate.

3) higher stock–bond correlation that undermines 60/40 defenses.

4) elevated valuations in risk assets; and

5) intense competition for quality deals.

Traditional ‘diversification’ often adds instruments that share the same underlying risks.

2) Why Bitcoin? Three strategic roles

A) Preservation: a programmatic hedge against monetary debasement

Bitcoin’s monetary policy is fixed in decentralized code practically impossible to alter, supply is asymptotically capped at 21 million, and issuance is transparently reduced over time. This removes discretionary dilution risk. In a world where deficits are structural and balance‑sheet expansion is a recurring tool, exposure to an asset with rule‑based scarcity can help protect intergenerational purchasing power.

In practice, Bitcoin is probably best understood as a modern complement to gold and quality real assets. It is not a panacea: drawdowns can be severe, and short term price behavior is volatile. But over long horizons, its scarcity mechanism makes it a credible hedge against currency debasement—especially when sized prudently within a diversified portfolio.

Exhibit 1. Macro context: USA - Total Federal Outlays and Revenues

Source: CBO's February 2024 report The Budget and Economic Outlook: 2024 to 2034.

Exhibit 2. Macro context: USA- Federal Debt Held by the Public as a % of GDP

Source: CBO's February 2024 report The Budget and Economic Outlook: 2024 to 2034.

Exhibit 3. Bitcoin vs. 2Y inflation expectations (YoY)

Source: Onramp Bitcoin, Federal Reserve Bank of St Louis, Investing.com

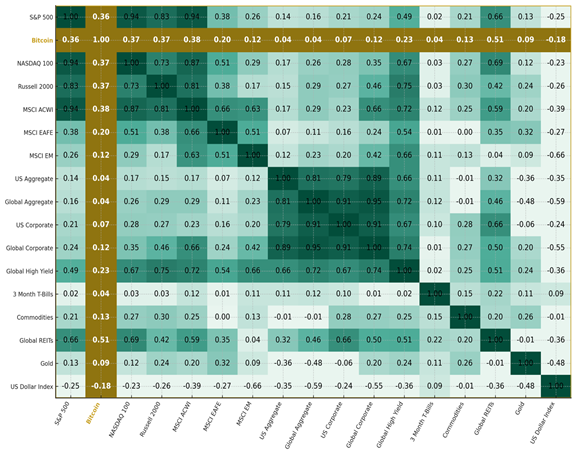

B) Diversification: low correlation when it counts

Diversification works only if return drivers differ. Bitcoin’s return stream is largely orthogonal to earnings cycles and interest‑rate policy because it is driven by protocol rules, network adoption, and liquidity cycles unique to the asset. Over multi‑year windows, correlations with broad equities and aggregate bonds have tended to hover near zero. For families already fully exposed to equity beta, credit, and real assets, “different’ matters more than ‘more.”

A 1–5% sleeve typically suffices to introduce this independent risk/return profile. The goal is not to chase every rally but to insert a genuine diversifier that can buffer the portfolio during synchronized sell‑offs in traditional assets. Paired with rules‑based rebalancing, even a small sleeve can contribute meaningfully to long-term portfolio resilience.

Exhibit 4. Correlation Matrix — Bitcoin & Major Asset Classes - Jun 30, 2020 – Jun 30, 2025

Source: Data – Bloomberg; Calculations – Onramp Bitcoin

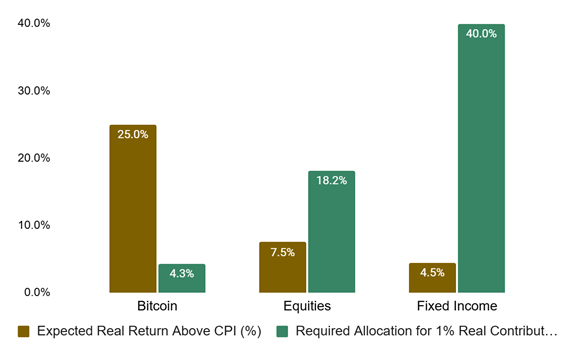

C) Growth optionality: asymmetric upside from a capped‑supply network

Families require growth to offset inflation and fund future obligations. Bitcoin’s long‑term return profile has been characterized by high compounding potential alongside high volatility. As adoption expands while supply remains capped, the asset exhibits asymmetric upside akin to owning a call option on a growing monetary network.

Capital efficiency is an additional benefit: to add a modest increment to expected real return, a small Bitcoin sleeve can substitute for much larger shifts in equities or bonds, preserving liquidity for other priorities. For many families, the asset also serves as a bridge to next‑gen engagement—digital‑native heirs intuitively understand its design and relevance.

Exhibit 5. CAGR vs. traditional assets and allocation required for +1% expected real return

3) Implementation without drama

A. Sizing and phasing

Target a 1–5% range of total assets, calibrated to spending needs and drawdown tolerance. Families with higher liquidity requirements or lower risk appetite should sit at the low end; others can scale by policy once governance and custody are battle‑tested. Phase entry using dollar‑cost averaging over several quarters to desensitize timing and build cultural comfort. Pair with a rebalancing band (e.g., ±100–200 bps) to harvest volatility mechanically.

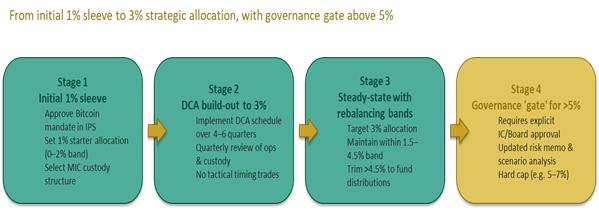

Exhibit 6. Policy pathway: start at 1%, DCA to 3%, quarterly rebalancing bands, governance ‘gate’ for >5%

B. Liquidity: a total‑return playbook

Bitcoin does not pay a coupon. Treat it as a total‑return sleeve. Monetize a small, rules‑based portion of gains during favorable windows—for example, trim when the sleeve exceeds its upper band—to fund distributions, capital calls, or new commitments. This converts appreciation into liquidity without dismantling the core exposure. Keep a written policy to avoid ad‑hoc decisions during volatility spikes.

C. Resilient Custody

Institutional‑grade custody is non‑negotiable. The emerging best practice is multi‑institution, multi‑signature custody (MIC). Keys are split across qualified custodians and/or trustees in distinct jurisdictions; transactions require 2‑of‑3 or 3‑of‑5 approvals; and insurance coverage is in place. MIC reduces single points of failure, strengthens legal resilience, and enforces dual‑control.

Decide up front:

· Movement thresholds (e.g., board approval above defined amounts).

· Jurisdiction strategy (custodians across complementary regulatory regimes).

· Whitelisting and address‑control procedures for outbound transfers.

Exhibit 7. Example of Multi Institution Custody Scenario

D. Policy, compliance, and documentation

Add a Bitcoin mandate to the Investment Policy Statement (IPS): purpose (hedge/diversifier/growth), target range and phasing, rebalancing rules, liquidity plan, custody standards, valuation/pricing source, reporting cadence, and escalation criteria. Maintain live tax and regulatory checklists; rules evolve. Schedule quarterly reviews and an annual deep dive.

Sample IPS insertion (illustrative)

Purpose and role: Bitcoin is included as a strategic diversifier and potential hedge against monetary debasement, with long‑term growth optionality. Target allocation: 3% of total assets, with an allowed range of 2–5%. Phasing: Dollar‑cost average over at least four quarters to initial target. Rebalancing: Maintain within ±150 bps of target; trims above the upper band fund distributions or new commitments. Custody: Assets held with qualified custodians in a multi‑signature, multi‑institution structure, with insurance coverage. Compliance: All activity subject to legal and tax review; pricing from an approved source; quarterly reporting to the Investment Committee. Review: Annual deep dive and quarterly check‑ins; any move beyond 5% requires explicit IC approval.

4) Values and legacy: making the impact case credible

Many families integrate philanthropy and values into their investment approach. With careful framing, Bitcoin can reinforce—rather than conflict with—key priorities:

· Financial inclusion: borderless access to savings and payments where banking is fragile; lower‑cost remittances in certain corridors.

· Human rights: resilience to censorship and seizures under authoritarian regimes; ability to support at‑risk communities when traditional rails are restricted.

· Energy transition: miners as flexible buyers of last resort for intermittent renewables; potential methane‑mitigation when collocated with flared‑gas sites.

Back the narrative with data and governance: disclose custody standards, report on energy‑use metrics where appropriate, and align philanthropic initiatives with measurable outcomes. Include next gen family members in oversight roles to strengthen continuity and engagement.

5) Key risks and practical mitigations

· Price volatility: mitigate via small sizing, DCA entry, and rules‑based rebalancing bands.

· Operational/custody risk: mitigate via MIC, segregation of duties, whitelists, and audited processes.

· Liquidity risk: plan liquidity with a total‑return playbook; avoid forced selling during stress.

· Reputational risk: align narrative with values; communicate policy and safeguards clearly to stakeholders.

6) Mini‑checklist for the IC pack

· Mandate: Target band (e.g., 1–3%); escalation criteria to 5%.

· Phasing: DCA schedule by quarter; volatility gates; pause conditions.

· Rebalancing: banded policy with trims to fund distributions; avoid discretionary chasing.

· Custody: MIC with 2‑of‑3; jurisdiction diversification; insurance requirements.

· Operations: dual‑control workflows; address whitelists; cold‑storage standards; audit trail.

· Compliance/Tax: counsel and CPA review; disclosures; board minutes and approvals.

· Education: standing agenda item; next-gen participation

7) Methodology notes (for the investment committee)

Inflation expectations: When comparing Bitcoin behavior with inflation regimes, use survey‑based expectations and market‑based measures (e.g., breakeven inflation). Regime identification should avoid look‑ahead bias and should be robust to alternative windows (12–36 months).

Real‑return framing: When evaluating contribution to expected real return, anchor to a long‑term inflation assumption (e.g., 2%). Illustrations that compare allocations needed to add +1% real return should clarify that all results are sensitive to the horizon, regime definition, and the choice of proxies for each asset class.

Risk measurement: For drawdown analysis, use peak‑to‑trough declines on closing prices and report both depth and duration. For family‑office governance, emphasize scenario‑based stress (e.g., policy shock, liquidity crunch, sharp tightening) rather than relying solely on variance.

Back testing hygiene: Use transparent data sources, specify windows, and put confidence bands around point estimates. Where possible, show robustness checks (e.g., multiple start dates for DCA, alternative rebalance bands).

8) FAQs for principals and trustees

Short answers you can use in Investment Committee packs and trustee briefings:

· “Isn’t Bitcoin too volatile?” — The sleeve is intentionally small (1–5%) and phased in. Volatility at the sleeve level can be an asset when rebalancing is systematic, because it realizes gains without relying on market timing.

· “Why not just buy a crypto fund or ETF?” — Pooled vehicles can be appropriate, but direct ownership plus institutional custody (or a separately managed account with qualified custodians) gives greater control over counterparties, geography, and security policies.

· “What about taxes?” — Tax treatment varies by jurisdiction. Maintain a transaction log and pricing source and obtain tax advice before implementing rebalancing or income‑generation overlays.

· “Can we earn yield on Bitcoin?” —A conservative family office can treat Bitcoin as a total‑return asset and generate liquidity via policy‑based trims instead.

Conclusion

In an era of fiscal imbalances and correlated traditional assets, Bitcoin has a role as a strategic complement for family offices aiming to preserve purchasing power, diversify risks, and capture growth optionality. Its fixed supply, decentralized governance, and independence from fiat policies position it as a hedge against monetary debasement, with historical correlations to equities and bonds near zero over multi-year periods[1]. A modest 1-5% allocation can enhance portfolio resilience—historically delivering high compound annual growth rates (CAGRs) while allowing systematic rebalancing to harvest volatility—without overwhelming liquidity or governance. Implementation requires dollar-cost averaging (DCA) for phased entry, multi-institution, multi-signature custody to mitigate operational risks, and integration into the Investment Policy Statement (IPS) with clear rebalancing bands and liquidity plans. Key risks like price volatility and custody failures are addressable through small sizing, rules-based processes, and audited controls. Overall, a prudent Bitcoin sleeve aligns with intergenerational mandates, offering asymmetric upside in a capped-supply network amid structural macro pressures, provided families consult advisers for tailored execution.

About The Authors

Glenn Cameron is Global Head of Onramp Institutional and Chief Investment Officer of Acropolis Treasury, where he works with family offices, institutions and corporate treasuries on Bitcoin strategy, governance and portfolio integration. He has more than two decades of experience in multi asset portfolio management and investment consulting across the US, UK, Europe, the Middle East and Africa. Prior to joining Onramp, Glenn was Senior Investment Consultant & Head of Digital Assets at Cartwright, where he led the advice behind the first British pension scheme allocation to Bitcoin, and before that he was a Portfolio Manager & Head of Asset Allocation at Sanlam Investments, managing multi asset and alternative investment portfolios. He has held earlier leadership roles in investment consulting and derivatives trading and holds the CFA and FMVA designations. Contact: glenn@onrampbitcoin.com

Onramp Institutional is the institutional advisory and solutions arm of Onramp, focused exclusively on Bitcoin for fiduciaries. The team works with boards, CIOs, treasurers and risk committees to build a defensible process around Bitcoin: executive and committee briefings, portfolio and liquidity modelling, wrapper and custody design (including multi institution custody vaults), and governance and audit documentation. Onramp operates alongside clients’ existing legal, tax and consulting relationships to help them evaluate, size and structure modest Bitcoin sleeves that are auditable, compliant and operationally robust for family offices and other long term allocators: www.onrampbitcoin.com

Marc J. Sharpe is a global investment executive and board member with a distinguished career spanning family office management, private equity, venture capital, and investment banking. Known for his strategic insight, deep expertise in family office governance, and ability to foster innovation and value creation, Mr. Sharpe has built and led investment platforms that deliver sustainable growth while navigating complex financial and operational challenges. His leadership style emphasizes integrity, continuous improvement, and long-term partnerships that generate significant stakeholder value. Mr. Sharpe is the Founder and Chairman of The Family Office Association, a premier global peer network of single-family offices. Since 2007, he has cultivated a community of senior family office executives and principals representing some of the world's wealthiest families, promoting education, shared-best practices, and co-investment opportunities. Under his leadership, TFOA has become a trusted forum for collaboration, market insight, and proprietary investment deal flow on a global scale. He also teaches an MBA class on “The Entrepreneurial Family Office” as an Adjunct Professor at Rice University and Southern Methodist University. Mr. Sharpe holds an M.A. from Cambridge University, an M.Phil. from Oxford University, and an MBA from Harvard Business School. Contact: marc@tfoa.me

The Family Office Association (“TFOA”) is a global peer network that serves as the world’s leading single family office community. Our group is for education, networking, selective co-investment, and a resource for single family offices to share ideas, deal flow and best practices. Members are not actively marketing products or services to other members, and no contact information or email lists will ever be shared. Since our founding in 2007, TFOA has led the global single family office community by delivering world-class educational content, unique networking opportunities, and exceptional thought leadership to our highly curated network of the world’s largest and wealthiest families: www.tfoa.info

Disclosures

The Family Office Association (“TFOA”) is a peer network of single family offices. Our community is intended to provide members with educational information and a forum in which to exchange information of mutual interest. TFOA does not participate in the offer, sale or distribution of any securities nor does it provide investment advice. Further, TFOA does not provide tax, legal or financial advice. Materials distributed by TFOA are provided for informational purposes only and shall not be construed to be a recommendation to buy or sell securities or a recommendation to retain the services of any investment adviser or other professional adviser. The identification or listing of products, services, links, or other information does not constitute or imply any warranty, endorsement, guaranty, sponsorship, affiliation, or recommendation by TFOA. Any investment decisions you may make based on any information provided by TFOA is your sole responsibility. The TFOA logo and all related product and service names, designs, and slogans are the trademarks or service marks of The Family Office Association. All other product and service marks on materials provided by TFOA are the trademarks of their respective owners. All of the intellectual property rights of TFOA or its contributors remain the property of TFOA or such contributor, as the case may be, such rights may be protected by United States and international laws and none of such rights are transferred to you as a result of such material appearing on the TFOA web site. The information presented by TFOA has been obtained by TFOA from sources it believes are reliable. However, TFOA does not guarantee the accuracy or completeness of any such information. All such information has been prepared and provided solely for general informational purposes and is not intended as user specific advice.

This material is for educational purposes only and is not investment, legal, accounting, or tax advice. It does not constitute an offer to buy or sell any security or digital asset, or a solicitation to engage in any investment strategy. Past performance is not indicative of future results. All investments involve risk, including possible loss of principal. Families should consult their advisers and consider their unique circumstances before making any investment decisions.

[1] As shown in the correlation matrix from June 2020 to June 2025 (Source: Bloomberg data via Onramp Bitcoin).